Thinking of buying your first home in Victoria? The Victorian Government has a number of schemes and grants available to help first-time home buyers fast-track their dream of homeownership.

In this blog, we will look at all the incentives available to first-home buyers in Victoria, including the First Home Guarantee Scheme, The First Home Grants, Stamp Duty Exemptions and more.

1. THE HOME GUARANTEE SCHEME (HGS)

The Home Guarantee Scheme (HGS) is an Australian Government initiative to support eligible home buyers to purchase a home sooner and is administered by the National Housing Finance and Investment Corporation (NHFIC).

The federal government has announced significant changes to the Home Guarantee Scheme which will greatly expand the number of people eligible to participate in the scheme. These will be effective from 1 July 2023:

Friends, siblings, and other groups of family members can jointly apply for the First Home Guarantee and Regional First Home Buyer Guarantee.

Non-first-home buyers who have not owned property during the last 10 years can also apply.

Borrowers who are single legal guardians of children – such as their aunts, uncles and grandparents – can apply for the Family Home Guarantee.

Australian Permanent Residents are eligible to apply for all three schemes: First Home Guarantee, Regional First Home Guarantee and Family Home Guarantee

The HGS includes:

The First Home Guarantee (FHBG)

The Regional First Home Buyer Guarantee (RFHBG)

The Family Home Guarantee (FHG)

1.1 FIRST HOME GUARANTEE

The First Home Guarantee is a Government incentive that allows first home buyers to purchase their first home with a deposit as low as 5%, without the need to pay Lenders’ Mortgage Insurance (LMI).

Spots: 35,000 places available per financial year

Income Limits: Single: $125K, Joint: $200K

Price Cap: $800K (for Victoria Capital Cities and Regional Centres)

Type of Property: Newly constructed dwellings, off-the-plan dwellings, house and land packages, land, and a separate contract to build a new home.

Tip: For your best chance to secure as place in the scheme, have your tax returns done as soon as possible. To apply, you will need your latest Notice of Assessment from the Australian Taxation Office (ATO).

Further Information on First Home Guarantee

1.2 REGIONAL FIRST HOME

This scheme aims to support eligible Regional Victorians to purchase their first home sooner.

They can also now purchase their first home in the regional area with a deposit of as little as 5% of the property value and the government will guarantee the other 15%, allowing borrowers to avoid paying Lenders Mortgage Insurance.

Spots: 10,000 places available per financial year

Income Limits: Single: $125K, Joint: $200K

Price Cap: $650K (for Regional Victoria)

Type of Property: Newly constructed dwellings, off-the-plan dwellings, house and land packages, land, and a separate contract to build a new home.

Further Information on Regional Home Guarantee

1.3 FAMILY HOME GUARANTEE

This scheme aims to support eligible single parents with at least one dependent child in purchasing a family home, regardless of whether that single parent is a first-home buyer or a previous homeowner.

Eligible single legal guardians with at least one dependent child can now purchase a home with a deposit of as little as 2% without paying Lenders’ Mortgage Insurance.

Spots: 5,000 available per financial year until 30 June 2025

Income Limits: $125K

Other eligibility criteria apply.

Further Information on Family Home Guarantee

2. FIRST HOME SUPER SAVER SCHEME

The first home super saver (FHSS) scheme allows you to make voluntary contributions to your super, which you then can withdraw to buy a house.

You can withdraw up to $50,000 per person and contribute up to $15,000 into your super per year to use in this scheme.

Eligibility:

You intend to occupy the property for at least 6 months within the first 12 months you own it after it is practical to move in.

You can buy any residential property if it's in Australia.

You're also allowed to build a home with money from your FHSSS.

Further Information on Super Saver Scheme

3. THE VICTORIAN HOMEBUYER FUND

The Victorian Homebuyer Fund is a shared equity scheme, where if you have a 5% deposit, the Victorian Government could contribute up to 25% of the purchase price in exchange for an equivalent share in the property. This will save homeowners money by reducing their mortgage and removing the need for LMI.

Income Limits: Single: $128K, Joint: $204K

Price Cap & Property Type: $950,000 (Metropolitan Melbourne and Geelong) and $600,000 (Regional Victoria)

Eligibility: occupy the purchased property as your principal place of residence

Further Information on Victorian Homebuyer Fund

4. FIRST HOME BUYERS GRANT

The First Homeowner Grant is a lump sum of cash ($10,000) available to first homeowners to help with the cost of buying a first home or vacant land to build a home on. The Grant doesn’t have to be repaid, and it’s not taxable.

Price Cap: $750,000 or less.

Property Type: Newly built houses, townhouses, apartments, units or similar are entitled to the grant.

Eligibility: The grant is available for Australian citizens or permanent residents aged 18 or over who are willing to occupy the house as a Principal Place of residence for at least 12 months.

Further Information on First Home Buyers Grant

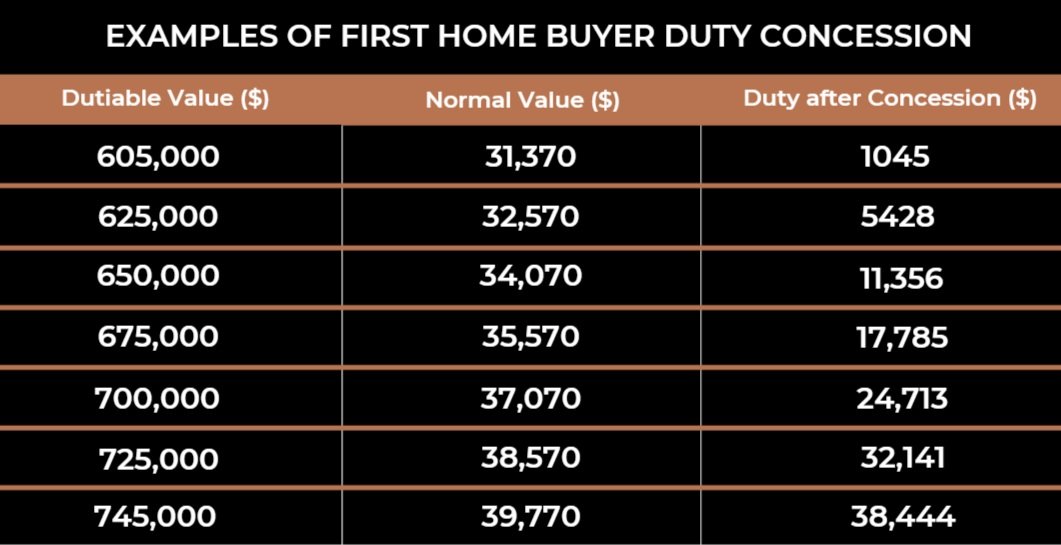

5. FIRST HOME BUYER STAMP DUTY BENEFITS

Stamp duty, also known as land transfer duty, is the tax you are required to pay to the Victorian State Government when you buy property in Victoria.

If you buy a first home valued up to $600,000, you can apply for a full exemption

If you buy a first home valued at between $600,001 and $750,000, you can apply for a stamp duty concession

If you buy your first home on vacant land, you’ll only be charged duty on the vacant land – if you build your home and move into the property within 12 months of settlement of the land contract

If you buy your first home off the plan (sign a contract for a property that hasn’t been built yet), you may be eligible for an off-the-plan concession

FIRST HOME BUYER STAMP DUTY EXEMPTION

Unlike FHOG, VIC Stamp Duty benefits apply to existing homes, as well as vacant land.

See full Eligibility Requirements: First Home Buyer Stamp Duty - Eligibility

To calculate your land transfer duty: Stamp Duty Calculator Victoria

Can I apply for multiple government grants and schemes?

Yes, you are eligible.

For example, an eligible first-home buyer can apply for and qualify for the First-Home Owners Grant (FHOG) and the First Home Guarantee, while paying no stamp duty.

Since each government grant/scheme has its own eligibility criteria and timelines, qualifying for all of them can be confusing. Get in touch with us today to determine how best to proceed.

How do I know if I am eligible?

The federal government's National Housing Finance and Investment Corporation (NHFIC) website features a short questionnaire that can help you see if you are eligible for one of the schemes.

You can access the eligibility checker here

Grants change regularly, so it is always a good idea to review the State Government’s Website to confirm your eligibility or simply contact us.

HOW CAN WE HELP?

At SONI, we simplify property investment with our experience and knowledge.

We helped several first-home buyers secure their first homes with a deposit of just $10,000 by using government-financial assistance programs and our strong network of professionals.

A simple chat with our experts can clarify your questions and give you the confidence you need to get started.

Here's what you'll get:

An accurate understanding of the various government Grants & Incentives available for First Home Buyers.

Understand the initial capital required to purchase your dream home and the ongoing expenses and cash flow requirements.

Understand what type of property will best suit your needs and take the steps to get your home faster.

Click here to read our success stories

Reach out to us today if you are looking for the right partner that is going to be there with you every step of the way.